In the world of foreign exchange trading, understanding the various account types is crucial for success. One of the most popular account types among professional traders is the ECN Forex trading account. This article aims to shed light on what ECN trading accounts are, their advantages, disadvantages, and some tips on how to choose the right one for you. Whether you are an experienced trader or just starting, the information in this article will be valuable for your trading journey. To learn more about trading strategies, visit ecn forex trading account https://trading-vietnam.com/.

What is an ECN Forex Trading Account?

ECN, or Electronic Communication Network, is a trading platform that connects traders directly with other market participants, including banks, financial institutions, and other traders. Unlike traditional trading accounts, where orders are executed through a dealer, ECN accounts facilitate a direct connection to the market, resulting in faster order execution and better pricing.

How ECN Accounts Work

When you place a trade on an ECN platform, your order is matched with the best available prices from other participants in the network. This process is executed in real-time, which means that spreads are typically lower, and orders can be filled more efficiently. Moreover, ECN accounts provide greater transparency, as traders can see the depth of the market and the available liquidity.

Advantages of ECN Forex Trading Accounts

- Lower Spreads: ECN accounts often offer variable spreads, allowing traders to benefit from lower costs during different market conditions. This reduction in trading costs can significantly enhance profitability over time.

- Faster Order Execution: Since ECN accounts connect traders directly to the market, order execution can be considerably faster, reducing the likelihood of slippage.

- Transparency: Traders have access to the full range of market prices, enabling them to make informed decisions based on real-time data.

- No Dealing Desk Intervention: ECN accounts eliminate the possibility of conflicts of interest, as brokers do not act as market makers. This ensures that your trades are not influenced by the broker’s actions.

- Access to Better Liquidity: ECN accounts allow traders to interact with a wide range of liquidity providers, enhancing the overall trading experience.

Disadvantages of ECN Forex Trading Accounts

- Higher Minimum Deposits: To open an ECN account, traders may need a larger initial deposit compared to standard accounts. This can be a barrier for novice traders.

- Commission Fees: Although spreads may be lower, ECN accounts typically charge a commission on trades, which can add up for frequent traders.

- Complexity: ECN trading can be more complex than standard accounts, requiring a thorough understanding of the trading environment and careful strategy formulation.

Choosing the Right ECN Forex Trading Account

When selecting an ECN Forex trading account, there are several factors to consider:

Broker Reputation

Research different brokers that offer ECN accounts. Look for reviews, regulatory status, and overall reputation in the industry. A dependable broker will ensure a smooth trading experience.

Account Features

Examine the features offered by different ECN accounts. Ensure that they meet your trading needs regarding spreads, commissions, and minimum deposits. Some brokers may offer additional tools or features that can enhance your trading experience.

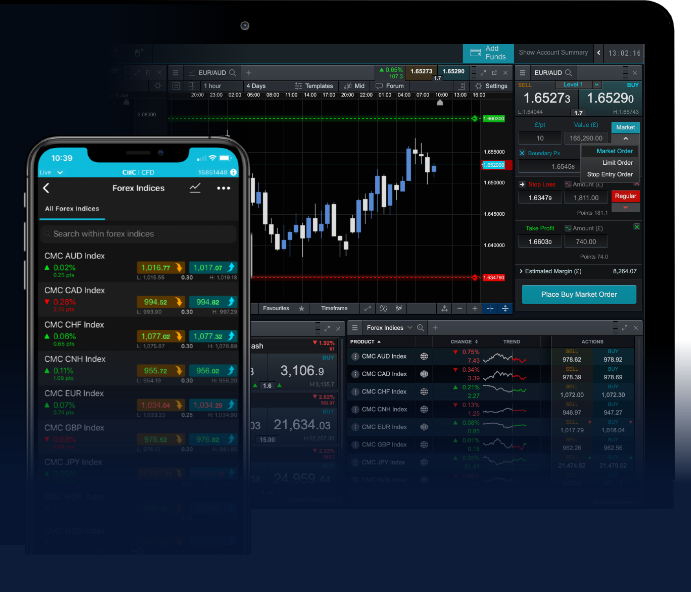

Trading Platform

The trading platform is a vital component of your trading experience. Ensure that the broker provides a user-friendly and reliable platform that supports the ECN trading model. Popular platforms include MetaTrader 4 and 5, which offer advanced charting tools and indicators.

Customer Support

Effective customer support is essential for addressing any issues that may arise during trading. Look for a broker that provides responsive customer service via multiple channels, including live chat, email, and phone support.

Conclusion

ECN Forex trading accounts provide a seamless way for traders to access the foreign exchange market, often resulting in lower costs and better execution. While they may not be suitable for every trader, the benefits of lower spreads, faster execution, and increased transparency make them an attractive option for many. By carefully considering your needs and conducting thorough research, you can choose the right ECN account to enhance your trading strategies and overall success in the Forex market.

El carrito esta vacío

El carrito esta vacío